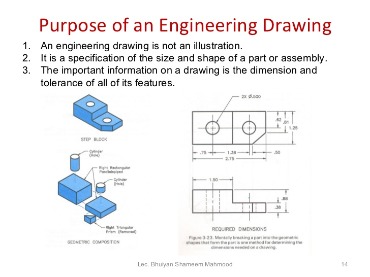

Contents

This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is financial, investment, legal, tax or other advice and no reliance should be placed on it. If you have an open short position that’s profiting from a downtrend and you spot a hammer, it might be time to exit before an upward move eats into your profits. At a minimum, I always want a hammer candle to be as big as the recent candles on the chart if I am going to use it as an entry or exit signal in my trading. This suggests that the previous bullish momentum may pause or reverse. Two additional things that traders will look for to place more significance on the pattern are a long lower wick and an increase in volume for the time period that formed the hammer.

In a candlestick chart, every candle relates to one period, according to the timeframe you select. If you look at a daily chart, every candle represents one day of trading activity. If you look at a 4-hour chart, every candle represents 4 hours of trading. It is characterized by a long lower shadow and a small body. At times, the candlestick can have a small upper shadow or none of it. As part of its characteristic appearance, it has a relatively tiny body, an elongated lower wick, and a small or no upper wick.

The first is the relation of the https://forex-trend.net/ price to the opening price. In the example above, the price reached a new low and then reversed into a higher level. The area that connects the lows is referred to as the zone of support. It acts as a rubberstamp to the reversal signal yielded by the hammer candlestick.

https://topforexnews.org/s that appear at support levels or after several bearish candles are bullish. Inverted hammers at resistance levels or after several bullish candles are bearish. Longer hammer candles with longer wicks are stronger than short hammers with short wicks. This is because longer candlesticks cover more price and so usually contain more order flow and activity. The hammer and hanging man candlesticks are similar in appearance, and both patterns signal trend reversals.

Yes, they do..as long you are looking at the https://en.forexbrokerslist.site/s in the right way. As we have discussed this before, once a trade has been set up, we should wait for either the stoploss or the target to be triggered. It is advisable not to do anything else, except for maybe trailing your stoploss. Of course, we still haven’t discussed trailing stoploss yet. The shooting star looks just like an inverted paper umbrella.

To trade when you see the inverted hammer candlestick pattern, start by looking for other signals that confirm the possible reversal. If you believe that it will occur, you can trade via CFDs or spread bets. These are derivative products, which mean you can trade on both rising and falling prices. The bearish inverted hammer is called a shooting star candlestick. It looks just like a regular inverted hammer, but it indicates a potential bearish reversal rather than a bullish one. In other words, shooting stars candlesticks are like inverted hammers that occur after an uptrend.

The candle looks like a hammer, as it has a long lower wick and a short body at the top of the candlestick with little or no upper wick. While a hammer candlestick indicates a potential price reversal, a Doji usually suggests consolidation, continuation or market indecision. Doji candles are often neutral patterns, but they can precede bullish or bearish trends in some situations. The hammer and the inverted hammer candlestick patterns are among the most popular trading formations. Apart from the Hammer candlestick, a Doji has a tiny body or no body at all.

As with any trade, it is advisable to use stops to protect your position in case the hammer signal does not play out in the way that you expect. The level at which you set your stop will depend on your confidence in the trade and your risk tolerance. As we have seen, an actionable hammer pattern generally emerges in the context of a downtrend, or when the chart is showing a sequence of lower highs and lower lows.

If the price moves significantly below the candle’s opening price but quickly recovers, it forms the Hammer chart candlestick pattern. The pattern is recommended to be bullish or confirmed by the following bullish candlestick. A Buy Stop order should be placed at the opening price of the next candlestick after the confirmation.

StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date.

A protective Stop Loss should be placed below the Hammer’s low or at the opening or closing price of the candle’s real body. Hammer and inverted hammer candlestick patterns are a key part of technical trading, forming the building blocks of many strategies. Learn all about how to trade the different types of hammer here. After all, no technical analysis tool or indicator can guarantee a 100% profit in any financial market. The hammer candlestick chart patterns tend to work better when combined with other trading strategies, such as moving averages, trendlines, RSI, MACD, and Fibonacci.

A paper umbrella consists of two trend reversal patterns, namely the hanging man and the hammer. The hanging man pattern is bearish, and the hammer pattern is relatively bullish. A paper umbrella is characterized by a long lower shadow with a small upper body. Brief study analyzing the potential of using the inverted hammer candlestick in trending of assets using python language. Traders can use the Hammer candlestick pattern as an additional tool for analyzing the market performance or as a part of their trading strategy.

But let’s dive in and analyze the meaning of a hammer candlestick. The default “Intraday” page shows patterns detected using delayed intraday data. It includes a column that indicates whether the same candle pattern is detected using weekly data. Candle patterns that appear on the Intradaay page and the Weekly page are stronger indicators of the candlestick pattern.

Free members are limited to 5 downloads per day, while Barchart Premier Members may download up to 100 .csv files per day. Also unique to Barchart, Flipcharts allow you to scroll through all the symbols on the table in a chart view. While viewing Flipcharts, you can apply a custom chart template, further customizing the way you can analyze the symbols. For reference, we include the date and timestamp of when the list was last updated at the top right of the page. Switch the View to “Weekly” to see symbols where the pattern will appear on a Weekly chart. Barchart is committed to ensuring digital accessibility for individuals with disabilities.

INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. The Structured Query Language comprises several different data types that allow it to store different types of information… Trade thousands of markets including Luft, EUR/USD, Germany 40, and gold. Commissions from 0.08% on global shares & extended hours on 70+ stocks.

A hammer candlestick is a trend reversal pattern spotted at the bottom of a downtrend. The pattern looks like a hammer, with a long lower shadow and a small body hence named as a hammer candlestick. It shows that sellers exerted considerable pressure during the session, but that buyers stepped in at the end and pushed prices upwards again. This is a very bullish sign and suggests that the downtrend may be coming to an end.

If it is a fresh short position, then you need to have a stop-loss. Since the open and close prices are close to each other, the paper umbrella’s colour should not matter. The entry of bears signifies that they are trying to break the stronghold of the bulls.

The hammer is a bullish pattern that typically forms at the end of a downtrend, while the Doji is a neutral pattern that can form at any time. Remember, hammers are a single candlestick pattern which means false signals are relatively common – and risk management is imperative. Most traders will tend to use nearby areas of support and resistance to place their stops and take profits. The hammer candlestick in Forex or any other market is easy to spot and analyze.

Hammer candlestick patterns are one of the most used patterns in technical analysis. Not only in crypto but also in stocks, indices, bonds, and forex trading. Hammer candles can help price action traders spot potential reversals after bullish or bearish trends. Depending on the context and timeframe, these candle patterns may suggest a bullish reversal at the end of a downtrend or a bearish reversal after an uptrend. Combined with other technical indicators, hammer candles may give traders good entry points for long and short positions. Many traders use Japanese candlestick charts to analyze the price of an asset.

The chart below shows a hammer’s formation where both the risk taker and the risk-averse would have set up a profitable trade. The price action on the hammer formation day indicates that the bulls attempted to break the prices from falling further, and were reasonably successful. The setup is almost the same as both of these patterns are bullish reversal formations.

Contents

The stock market consists of exchanges, such as the New York Stock Exchange and the NASDAQ, where stocks are listed. Buyers and sellers come to the stock market to buy and sell shares of stock in companies, which is facilitated by a brokerage firm. Individual and institutional investors come together on stock exchanges to buy and sell shares in a public venue. Most profit from stock investing is taxed via a capital gains tax. In many countries, the corporations pay taxes to the government and the shareholders once again pay taxes when they profit from owning the stock, known as “double taxation”.

If you’ve ever shopped with your child, they are likely already familiar with the process of buying and selling. Take the time to explain how buying stocks are similar to making purchases at the supermarket, yet different because the prices change more rapidly. A seller and a buyer both submit an asking price and selling price through a broker or an online platform.

But in most cases, it does mean you get a right to vote at those meetings, if you choose to exercise it. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.

From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst. He and his wife, Melissa, share a passion for horses, polo, and eventing. Phil’s goal is to help you learn how to invest and achieve financial independence. Phil Town is an investment advisor, hedge fund manager, 3x NY Times Best-Selling Author, ex-Grand Canyon river guide, and former Lieutenant in the US Army Special Forces. Central to the Rule #1 investing strategy, and the reason it works, is only investing in WONDERFUL businesses. And you’re well on your way to learning the basics of the language.

Our estimates are based on past market performance, and past performance is not a guarantee of future performance. This sector classification makes it easy for investors to tailor their portfolios according to their risk tolerance and investment preference. Aggressive investors may prefer more volatile sectors such as information technology, financials, and energy. The priority for stock exchanges is to protect investors through the establishment of rules that promote ethics and equality.

If you want to launch one and are interested in recruiting a pool of investors, where would you find these people? You could place an ad in the paper or online, or you could simply contact friends and family. But what if some of your initial investors decide a year later that they want to sell their shares? They would each have to go out and find a new buyer, which might prove difficult, especially if the company isn’t performing very well.

Your decision about whether you want to speculate on the future value of the asset without taking ownership of it. A share’s value will vary depending on whether you’re looking at its fair value or its market value. The fair value is the intrinsic value of a stock based on the company’s fundamentals, while the market value is the amount that individuals are currently willing to pay for the stock. Trading shares means that you’re speculating on share price movements without taking direct ownership. Trading is usually favored by people who are looking to take a short-term position on a company’s share price – perhaps during periods of increased volatility or market activity.

Instead, you are making a loan to the company, and the bond comes with a maturity date. The best-case scenario of owning a bond is that you get your money back on that date with some additional interest paid out along the way. Bonds have a higher priority of repayment in the event of a company’s liquidation, which means they are safer than stocks – though you can still lose some or all of your money.

Get more from a personalized relationship with a dedicated banker to help you manage your everyday banking needs and a J.P. Morgan Private Client Advisor who will help develop a personalized investment strategy to meet your evolving needs. Contact your nearest branch and let us help you reach your goals. Whether you prefer to independently manage your retirement planning or work with an advisor to create a personalized strategy, we can help. Rollover your account from your previous employer and compare the benefits of Brokerage, Traditional IRA and Roth IRA accounts to decide which is right for you.

However, investing in the stock market requires a long time horizon, so it’s best to think of your investments in terms of their long-term value. If you decide to buy a stock, you’ll often buy it not from the company itself, but from another investor who wants to sell the stock. Likewise, if you want to sell a stock, you’ll sell to another investor who wants to buy. This is how ordinary people invest in some of the most successful companies in the world. For companies, stocks are a way to raise money to fund growth, products and other initiatives.

Analysts use indices to track the performance of a specific group of stocks on an exchange. For example, the FTSE 100 represents the performance of the top 100 companies on the LSE by market capitalisation. He then sells those shares for $20 each, the current price, which gives him $2,000. If the stock then falls to $10 a share, the investor can then buy 100 shares to return to his broker for only $1,000, leaving him with a $1,000 profit.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Opinions expressed here are author’s alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. For example, if a business that you invested in closes its doors, your investment is likely gone for good.

NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

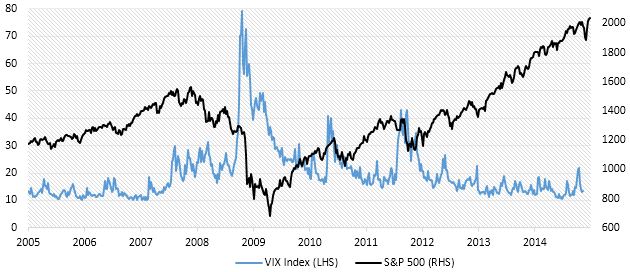

It’s also worth noting that bond prices and interest rates move inversely to one another. The stock market helps companies raise money to fund operations by selling shares of stock, and it creates and sustains wealth for individual investors. Often when discussing the stock market, people generalize “the market” to a stock index. Stock indexes, such as the S&P 500 or the Dow Jones Industrial Average, are a representation of the performance of a large group of stocks or a particular sector. These are used as a benchmark to compare the performance of individual stocks or an entire portfolio. For example, the S&P 500 index tracks the performance of 500 of the largest publicly traded companies in the U.S.

Once you’ve decided what kind of account you want, you’re ready to open an account at a provider called a brokerage. When choosing a company, consider their fees and available investment options. HowTheMarketWorks.com® is a property of Stock-Trak, Inc., the leading provider of educational budgeting and stock market simulations for the K12, university, and corporate education markets. All information is provided on an “as-is” basis for informational purposes only, and is not intended for actual trading purposes or market advice. Quote data is delayed at least 15 minutes and is provided by XIGNITE and QuoteMedia. Neither Stock-Trak nor any of its independent data providers are liable for incomplete information, delays, or any actions taken in reliance on information contained herein.

In February 2012, the Investment Industry Regulatory Organization of Canada introduced single-stock circuit breakers. Their buy or sell orders may be executed on their behalf by a stock exchange trader. If the corporation chooses to pay an annual dividend, then shareholders will receive a cut of the profits every year. They’re more likely to issue growth stocks, in which all of the profits are reinvested. In this case, shareholders are banking on the fact that the right corporate management will help the company grow and generate even more profit. It’s this potential for future success that will help determine the stock price on the open market.

And if the shareholder holds onto a growth stock for long enough, he could eventually sell it for a significant gain. Trying to please thousands of anonymous shareholders is a difficult task for any corporation. The main reason that companies choose to issue stock to the public is to raise a large quantity of investment capital quickly through an initial public offering . The company then invests the $20 million in equipment and employees. The interesting thing about issuing stock is that even if the company is profitable, shareholders won’t necessarily receive a check in the mail each year with their cut of the loot.

https://business-oppurtunities.com/ who sell stock for less than they paid might be able to report the loss on their tax return. Funding for education can come from any combination of options and a J.P. Morgan Advisor can help you understand the benefits and disadvantages of each one. Compare between 529 Plans, custodial accounts, financial aid and other education options to help meet your goals. If you sell your shares for more than you paid for them, you keep the difference, which is referred to as a capital gain. Conversely, if you sell your shares for less than what you paid for them, this is called a capital loss.

This course is an introduction to the stock market and stock investing for novices and experienced investors alike. Professor DeGennaro uses simple analogies to explain the origin of stocks and other securities, as well as their relative risks. He stresses the danger of trying to beat the market by trying to pick winners, predict price trends, or otherwise find opportunities that other investors have missed. Far better, he counsels, to own a well-diversified portfolio of individual stocks or stock funds, which tend to grow as the economy grows. For anyone who owns stocks or is thinking of entering the market, this course provides indispensable advice. The stock market is one of the most important ways for companies to raise money, along with debt markets which are generally more imposing but do not trade publicly.

Any business that wants to sell shares of stock to private or public investors needs to become a corporation first. The legal process of turning a business into a corporation is called incorporation. Because all the buying and selling is concentrated in one place, and since it’s all done electronically, we can track the constantly fluctuating price of a stock in real time. Investors can watch, for example, how a stock’s price reacts to news from the company, media reports, national economic news and lots of other factors. Outside of a retirement account, you’ll need a brokerage account and broker to actually buy and sell stocks for you. The average person can’t walk into a stock exchange and buy stocks directly.

The advance your nursing career established listing requirements for shares, and rather hefty fees initially, enabling it to quickly become a wealthy institution itself. Additionally, investing in the stock market can offer you a way to create passive income. Now that you know what a stock and stock exchange is, what the stock market is, and what a brokerage is, let’s discuss how they all work together. People can’t just walk up to the New York Stock Exchange on Wall Street and buy or sell shares, though. When a stock is actually purchased or sold by the average person, it is done so through a brokerage.

The platform then automatically makes investments on your behalf, usually in funds that hold a variety of assets. However, you probably won’t be able to select your investments or buy individual stocks. You can opt for individual stocks and bonds or mutual funds, index funds and exchange-traded funds that contain hundreds of individual securities.

Contents

It means there’s almost a 50/50 chance the market will move either up or down. Still, if you read the signals correctly, you can get more information from this pattern. It shows that the bulls were strong but couldn’t stick to highs, and the price declined. Bears have gained momentum, and as a result, there’s a high chance of a strong downtrend. The signal is even more reliable when formed on the top of the uptrend; it can be stronger than a shooting star. Use a Doji in conjunction with other technical indicators, such as support and resistance levels, to make more informed trading decisions.

Nonetheless, there are several strategies that you can use to https://bigbostrade.com/ the pattern. In a chart, the long-legged doji will typically be in either of the two colors depending on the open and closing prices. The process of identifying the long-legged doji is relatively simple to use.

This is due to the high probability of reversal coming from the forming indecision in the market. It is not possible to predict future success based on past performance. The high leverage inherent in CFDs can result in a rapid loss of money. It is crucial for you to determine whether you are capable of taking the risk of losing your money when trading CFDs. A Doji is a type of candlestick pattern that is typically used to signal a potential reversal in the market. There are several different types of Doji patterns, but the most common is the standard Doji.

But when two identical types of candlestick form consecutively, then the probability of the result will increase. The Doji candlestick pattern can be a meaningful technical indicator when examined in collaboration with other indicators and market trends. It can be beneficial in analysing future price movements of securities by highlighting the momentary indecision in the market.

You can also see these when the market is waiting for an announcement. Although the Doji candlestick is neutral, this does not mean that there are no variations. Some of them can give clues and hints as to where the market might be looking to go next. By recognizing these different types of Doji candlesticks, you can get an idea of what has been going on in the market internally.

We’ve designed this FAQ to address the most commonly asked questions about doji candlesticks. The disadvantages of doji candlesticks come from the fact that they are neutral patterns at their core. This leads traders to take a position expecting a possible reversal, only for the doji to instead represent indecision before continuation. Doji patterns can be helpful for traders trying to identify market reversals or breakout opportunities but should not be used on their own. To confirm any potential signals from the Doji pattern, one should look at other technical indicators, such as volume, support/resistance levels, and trend lines.

After the doji candle closed, a sell order was placed a few pips below the candle with a stop loss a few pips above the same candle. The focus of this article is the long-legged doji, which looks like a cross in that it has a small body and long upper and lower shadows. The price action implies that the price opened, then rose sharply and then moved sharply below the open price and then closes at its open price.

A https://forexarticles.net/ is a type of single Japanese candlestick pattern formed when the high, open, and close prices are the same. The opening and closing prices are near the top of the candlestick, with a long line coming out of the bottom to indicate the low of the interval. This pattern occurs when bears temporarily push the price down, but bulls strengthen and push the price back up before the candlestick interval closes. A reversal pattern that can be bearish or bullish, depending upon whether it appears at the end of an uptrend or a downtrend . The first day is characterized by a small body, followed by a day whose body completely engulfs the previous day’s body and closes in the opposite direction of the trend.

Forex Admin Team is a dedicated group of financial professionals who are passionate about helping traders and investors grow their portfolios. We provide in-depth analysis of Forex Brokers, Stocks, CFDs, ETFs, and other financial instruments to help our readers make informed decisions. Doji simply means “change” and is typically used to signal a potential reversal in the market. If you see a Doji pattern, it’s important to pay attention to the market and see if the direction does indeed change. 89.1% of retail investor accounts lose money when trading CFDs with this provider. For example, if the Doji is followed by a long bullish candlestick, this could be a sign that prices are about to move higher.

So the https://forex-world.net/ can be used as a bearish reversal signal. It’s understood that, like any other indicator, it should be used alongside other signals. Every assumption should be confirmed by other market analysis tools. Relying on a single indicator is pretty reckless and risky.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. When a gravestone doji in a downtrend appears it is believed to be a weak signal or a continuation pattern as the sellers still managed to be active. You must also respect time as a circumstance, and all candlestick patterns on various time frames weaken or increase its signal strength. A Doji is a type of candlestick pattern that often indicates a coming price reversal. This pattern consists of a single candlestick with a nearly identical open and close. In a downtrend, the open is lower, then it trades higher, but closes near its open, therefore looking like an inverted lollipop.

After a long downtrend, like the one shown in Chart 1 above of General Electric stock, reducing one’s position size or exiting completely could be an intelligent move. The longer upper side of the gravestone Doji, also known as a ‘shadow’, suggests that the present market trend may be coming to an end and that the market could now be turning around. This forms when the buying and selling powers for an asset are at an equilibrium.

Hammer candlesticks form when a security moves significantly lower after the open, but rallies to close well above the intraday low. If this candlestick forms during a decline, then it is called a Hammer. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time.

Like other Doji days, this one normally appears at market turning points. A continuation pattern with a long, black body followed by another black body that has gapped below the first one. The third day is white and opens within the body of the second day, then closes in the gap between the first two days, but does not close the gap. Some of the most common places to see this would be in futures contracts that are far out in time, as there may or may not be any trades on a given day.

As you see, there is a significant gap down the next day, which bulls can’t close. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. At the opening bell, bears took a hold of GE, but by mid-morning, bulls entered into GE’s stock, pushing GE into positive territory for the day.

The candle appears often, ranking 6th out of 103 candles, where 1 is famous and 103 is unknown. The overall performance rank is well behind the leaders, at 83. As you might have noticed, we have observed three patterns instead of one. The doji candlestick patterns differ depending on the type and the current trend.

Drawdown is the difference between the high point and the next low point of your account balance. Assume a pip value of $0.092 per micro lot when using a USD account (pip values change over time. Always use the current pip value). If you find different trades that have big risk differences, you can apply more or less of the allocated amount to those trades. Once we start taking more than that, some of our trades are likely to be too heavily correlated and thus redundant.

A Step-Drawdown Test is an accelerated pumping test for a single well, designed to estimate the aquifer characteristics and performance of a pumped well under three successively higher pumping rates or steps under controlled flow. The test is suitable for a design production rate of 35 gallons per minute (gpm) or less.

A natural question you might have is what are you expected to do if you hit your monthly drawdown. There are several techniques you can perform to mitigate your risk if you hit your monthly stop loss level. For example, you could completely unwind your risk and flatten your positions. You could fxdd review also hedge your exposure with options which allows you to reduce your exposure but remain in your positions. When you design your trading strategy you need to be cognizant of the types of drawdown you expect to occur, and be willing to accept this drawdown as part of your trading business.

The table I have drawn on the chart shows the amount of gain required to get an account back to… News Action Trader is a scalping forex robot that works on six currency pairs including gold. It is compatible with both MetaTrader 4 and MetaTrader 5, unlike regular scalpers. This robot is designed to be suitable for average execution span and spreads. It works very well with highly liquid currency pairs as it has a short holding time.

This would give you a 50 pip drawdown from the peak of the trade. If my account balance is $1,000 and I had an initial balance of $1,000, my drawdown is zero. If this trader told you he had a drawdown of €40, he would be talking about what I call the “drawdown risk”. When drawdowns occurred, they would reduce the trading size from 2% down to 1.6%.

The average price of a new well pump falls between $1,330 and $5,300, including installation and depending on the size and type of pump. Submersible pumps range between $400 and $2,000 while jet pumps cost $400 to $1,200. Solar units will run you at least $1,500. Hand pumps start at only $150.

In the next section, we will illustrate what happens when you use the proper risk management and when you don’t. Instead, they only risk a small percentage of their total bankroll so that they can survive those losing streaks. The reason is that good poker players practice risk management because they know that they will not win every tournament they play. Even professional poker players who make their living through poker go through horrible losing streaks, and yet they still end up profitable. Traders normally note this down as a percentage of their trading account.

Inversely, if you take less risk, you’re going to experience a small drawdown percentage. In this case, risking 10% per trade might not be such a good idea. In essence, drawdown forex is another risk metric to judge the performance of a trader. Sometimes a chart or a candlestick pattern may provide a decent entry signal if it is located at a certain level. A pin bar is one of the most reliable and famous candlestick patterns, and when traders see it on the chart, they expect the price to change its direction soon.

Drawdown is not the only risk and volatility management calculation to keep risk in balance the profits. Forex traders also pay a lot of attention to metrics like the Sharpe Ratio, Sortino Ratio and the Sterling Ratio. And this is exactly why it’s crucial to have your risk management strategies in place! More importantly, you need to set a maximum drawdown percentage you are willing to risk when you lose money in the markets.

This is caused by the market hovering below your entry-level and towards your stop loss. This is also considered a drawdown of the individual trade. Drawdown is the amount of a loss in an investment fund or account. For example, suppose you have $1,000 invested in what you think is a high-growth stock that’s worth $2,000. If the company tanked and its shares are now worth $500, your capital would be down to $750 (i.e. if you sell for what they’re worth). This implies that to get €50 of profit, the trader suffered a total unrealised loss of €150 (3 times more!) at a given moment.

As the statistical data has revealed, it’s more important to protect your downside because it’s much harder to recover from a period of large drawdowns. The severity of a drawdown will tell you more about your trading skills and the reliability of your trading strategy. The standard maximum drawdown in the investment world is about 20%. You need to start from scratch with your trading strategy and figure out what is going wrong.

If you trade Forex long enough, you will experience a losing streak. Justin Bennett is an internationally recognized Forex trader with 10+ years of experience. He’s been interviewed by Stocks & Commodities Magazine as a featured trader for the month and is mentioned weekly by Forex Factory next to publications from CNN and Bloomberg. Justin created Daily Price Action in 2014 and has since grown the monthly readership to over 100,000 Forex traders and has personally mentored more than 3,000 students.

It mostly trades after the main 10 am scalping hour when most news is realized and the US and European markets open. FXProud EA also comes with third-party verified real account trading results. Drawdown is useful in helping an individual fxflat review determine the risk involved with a particular investment proposition or as a performance indicator. Though individuals must realise that as a historic measure, there is no guarantee that past performance will continue into the future.

One of the salient features of InControl Reborn is the ability to work with other EAs on the same trading account at the same time. This is why it is a good idea to use appy pie this robot along with another EA that trades frequently. Other brand new features include accelerator mode, drawdowns control, two currencies, and risk diversity.

If you want to learn about losing streaks and drawdowns, including how the best traders handle them, you’re in the right place. I’m even going to share a simple 4-step process to control drawdowns that you can begin using right away. Drawdown is a difference between some local maximum point on your balance chart and the next following minimum point in that chart. It is the risk amount by which your strategy can go down during a streak of losses. There are two types of drawdown that are used as important properties of expert advisors — absolute drawdown and maximal drawdown. Political and government news and cause a sudden spike in a currency pair.

This could coincide with the largest peak to trough loss, but might not always be the case. You might have a flash crash that generated a maximum drawdown that lasts only a few weeks, which might be larger than the longest period where you experience a drawdown. Maximal drawdown is the maximal difference between the local maximum extremum and the next local https://forex-world.net/ minimum extremum in your equity chart. It tells you how low your strategy can go after getting some profit. Generally it is a good idea not to trade with expert advisors that have maximal drawdown higher than profit. But I do not recommend trading even with strategies or expert advisors that have maximal drawdown at levels higher than 25% of the net profit.

One trading pitfall that novice traders typically engage in, is trading multiple related currency pairs using the same trading strategy. You can start this process by determining the maximum loss you are willing to assume before you terminate the trading strategy. Your risk should be a function of the reward you are attempting to generate.

If your drawdown is big, you run a greater risk of losing your entire trading account, and if it’s modest, then you run less risk. The potential for a trading account to experience a drawdown is proportionate to its exposure to risk. Simply enter the starting balance, the number of consecutive losses and the loss per trade to calculate the expected drawdown. I’ve a question that, if I want to analyse & trade only one market, whether it be stock, commodity or forex, will it be right approach focusing on only one market? Off course I consider this with some comfortable trade set up & proper money management system with strong discipline. One way to prevent losses from piling up when you’re off your game is to set a weekly or monthly cap.

The two-month plan costs $247 while the lifetime license costs a one-time payment of $397. The maximum drawdown is calculated by the difference between the peak value in capital minus the trough value of the capital. If you keep experiencing situations where you get close to your maximum drawdown, that’s not an indication for you to extend the maximum drawdown that you allow in your trading strategy. I accept FBS Agreement conditions and Privacy policy and accept all risks inherent with trading operations on the world financial markets. Risk management is essential in the trading and investing process. For example, let’s assume that you have a fantastic trading strategy with an 80% win rate.

Contents

However, when it comes to picking a broker for yourself, you can’t simply choose the one which is good. Obviously, you can’t risk all your limefxs by making a poor choice this way, right? A lot of companies exaggerate and misrepresent their ability to provide exceptional services, optimal customer care being one of them. You are lucky if you opt for Monafoli as it is a broker that keeps its word at all times. No brokerage comes even remotely close to Monafoli when it comes to providing excellent customer care to traders. In most cases, pledging is the easy part; following through is the tough part, and Monafoli is well-equipped to manage any issues that arise.

Put in your risk criteria and let the Bitcoin Motion trading platform take care of the orders. After you have signed up and deposited funds its time to set up your trading system. When doing this you will be able to select the number of coins you want the automated software to trade.

If you have already invested in a scam, fraudsters are likely to target you again or sell your details to other criminals. If you’ve invested with a firm that’s not authorised by the FCA, limefx courses scam your limefx is not protected by the UK’s Financial Services Complaints and Compensation Scheme. MoneyHelper has information on investing and abouthow to find a financial adviser.

But if you’re not fluent in English, then asking for support from the limefx department requires time and seems like a complicated process. Therefore, we do not recommend limefx to people who are not good at English. limefx trades approximately 785 billion dollars per month, almost double the trading competitors such as limefx, which makes 400 billion dollars in a month. Thereby, the chances of this business hub being a scammer is very low. Aside from Bitcoin, other cryptocurrencies have likewise been lucky and have generated substantial gains for their owners.

You see, individuals have various preferences, and Monafoli understands that completely. Monafoli has an extensive asset index and has so many internet-based assets available on its forum. With this platform, you will never feel restricted to a few choices as you would always have a lot on your plate. No matter what your personal interests are, I am sure this platform would be able to cater to them in the way you want.

The customer support staff of Monafoli is responsive and efficient and makes every necessary effort for users’ comfort. Fraudsters posing as Binance – the cryptocurrency exchange – are emailing forex scam victims, putting them at serious risk of recovery fraud. You should seriously consider seeking financial advice or guidance before investing. You should make sure that any firm you deal with is regulated by us and never take limefx advice from the company that contacted you, as this may be part of the scam.

Prospective clients can open an FXGiants demo account on either the Live Floating Spread, Live Fixed Spread, or STP/ECN Absolute Zero accounts. Users have the choice of four currencies and can use the account to practice operating MT4 and trading on the financial markets. The platform allows me to enjoy trading and make profit at the same time. In general this forex broker offers powerful tools and helpful educational material. In addition the broker offers transparent pricing and really fast execution when requotes are extremely rare.

And they will help you to recover all your lost limefx that was denied from you by your scam broker. Videforex offers retail clients trading opportunities via their proprietary web trader and mobile application platform. The platform is easy-to-use with simple navigation features. The ‘gurus’ claim their incredible knowledge in the chosen markets is the reason they live this luxurious lifestyle.

Similarly to other scams, Ponzi and pyramid schemes often start with a con man marketing an limefx opportunity and promising high returns for an upfront payment. Ponzi schemes differ slightly as the first few investors will see benefits, encouraging them to share the scheme with friends and family, often sharing on social media too. Ponzi schemes tend to keep going as long as people are joining, but investors will eventually run out of money and disappear, leaving victims with nothing. Videforex offers clients its proprietary web trading platform.

In fact, the only similarity between them is that you are buying or selling them, pretty much that is it, everything else has differences. Some differences are large, others are quite small, but they are there. We are going to be looking at the differences between https://limefx.vip/ trading forex and trading stocks, there are a lot so we may not go over all of them, but you will surely get the idea that they are quite different beasts. I invited comments from CashFX and its promoter Richard Maude, particularly on what EverFX told me.

However, Stake is always updating their offering so I wouldn’t be surprised if this was rolled out in the future. Trading the markets is an art, which is hard to master but very fruitful in the long run. For most traders, the toughest aspect of trading in Forex is dealing with financial losses. All traders at the end of the year always take stock of their own trading activity. Stepsys has been on my radar for over 20 years, as he hops from one ‘get rich quick’ scheme to another.

By offering such outstanding services, limefx proves itself to be a genuine forex market. Signal seller scams involve a person or company selling information to victims on which trades they should make, claiming the information is based on professional forecasts and limefx scam are guaranteed to make money. Often, these scammers take a daily, weekly or monthly fee, but don’t offer any advice to help people make money. A lot of the time, these ‘companies’ will share testimonials from ‘legitimate’ sources to gain the victim’s confidence.

All contents on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalised advice before you make any trading or investing decisions. Daytrading.com may receive compensation from the brands or services mentioned on this website. Infinox – Infinox is a UK-based broker offering MT4 trading with tight spreads.

The Bitcoin Motion trading platform identifies potential trades using AI and then uses a network of brokers for the final execution of buy or sell orders. The AI determines what actions to take and passes on the orders to brokers who use CFDs on different platforms. It is not clear what is their offer, but it looks it’s a scam, because they promise “risk free returns” and investing is never risk free. Plus there is their affiliate program, the fact they are not authorized to provide limefx services, etc.

Содержание

To wszystko nie tylko efekt rakietowych prób reżimu z Korei Północnej, ale głównie zastanawiającego milczenia prezes Fed w Jackson Hole. Piątkowa sesja wystawiła na próbę siłę kupujących na rynku złota. Mimo prób obrony wsparcia w okolicach 1890 USD za uncję, ostatecznie zakończyły się one fiaskiem, a notowania złota runęły w dół do okolic 1847 USD za uncję na koniec piątkowej sesji.

Zarówno inflacja jak i ceny wynajmu nieruchomości w wielu polskich miastach nadal rosną, tym samym realny staje się scenariusz niewypłacalności części najemców. Od poniedziałku 4 lipca kurs złota spada (warto wiedzieć, że równo miesiąc temu 7 czerwca wynosił 1852,4 USD za uncję). Uncja złota wyceniona w USD potaniała o -3,64%, mimo że inflacja generalnie na całym świecie jest najwyższa od dekad. Srebro wycenione w amerykańskiej walucie potaniało jeszcze bardziej, bo o -11,83%. Jeśli chodzi o prognozę cenową, to pod koniec 2022 roku, wedle analityków Incrementum, uncja złota powinna kosztować około USD. Jednak nie warto będzie realizować zysków, tylko trzymać kruszec przez rozpoczętą dekadę, gdyż w 2030 roku uncja ma być warta około USD.

Narodowy Bank Węgier poniósł w ubiegłym tygodniu stopy procentowe o 185 punktów bazowych, z 5,9 do 7,75 proc. Tak duża podwyżka to również duże zaskoczenie dla wszystkich – ekonomiści spodziewali się, że bank podniesie stopy o 50 pkt bazowych, do poziomu 6,4 proc. Wiatru w żagle dolarowi dodają działania Rezerwy Federalnej. Amerykański bank centralny w połowie marca po raz pierwszy od 2018 r. Podniósł stopy procentowe, a następnie w maju podniósł je najmocniej od 20 lat . W efekcie stopa funduszy federalnych mieści się w przedziale 0,75-1%.

Obecnie na rynku wyceniana jest majowa podwyżka na poziomie 0,5 pkt. Zdaniem ekspertów Bank of America rosnąca inflacja, wciąż obecne ryzyko pandemii i konflikty geopolityczne sprzyjają inwestycjom w złoto. Oczekuje się, że średnia cena metalu szlachetnego w ciągu roku wyniesie $1925 za uncję. Na przykład bank amerykański JPMorgan zarobił w tym roku około $1 miliarda na handlu metalami szlachetnymi (przede wszystkim złotem).

W USA, strefie euro, Wielkiej Brytanii Japonii ten wskaźnik wzrósł o 15,7% od lutego do września. Niniejsza analiza została przygotowana przez jej autora samodzielnie z zachowaniem należytej staranności i stanowi wyraz jego opinii i obecnego stanu posiadanej wiedzy. Nie może być ona traktowana jako rekomendacja inwestycyjna w rozumieniu przepisów Rozporządzenia Ministra Finansów z dnia 19 października 2005 r. Ani autor tekstu, ani wydawca serwisu Business Insider Polska, nie ponoszą odpowiedzialności za decyzje inwestycyjne podjęte na podstawie lektury niniejszego materiału. Autor nie posiada instrumentów objętych analizą ani nie zamierza zawierać w ciągu najbliższych 72 godzin jakichkolwiek transakcji z udziałem tych instrumentów. Takie zachowanie rynku można uznać za zrozumiałe, bo posunięcia Fedu rzadko są dla inwestorów zaskoczeniem.

Pod koniec zeszłego tygodnia GUS opublikował czerwcowy odczyt inflacji, który wyniósł 15,6 proc. To mniej więcej tyle, ile zakładał konsensus rynkowy. To także najwyższy odczyt od ponad 25 lat, jednak za jej wzrost odpowiadają w głównej waluty mierze wzrosty cen nośników energii (3 proc.). Jakie zachowanie ceny metali szlachetnych przewidują eksperci w 2022 roku? Postanowiliśmy zebrać najważniejsze – naszym skromnym zdaniem – prognozy na rozpoczynający się właśnie rok.

Za 12 miesięcy ceny złota będą także na poziomie o 24 proc. W poniedziałek cena złota na światowym rynku przebiła poziom ostatni raz widziany w listopadzie ubiegłego roku. We wtorek euro wzniosło się ponad najwyższy poziom od stycznia 2015 r.

Pierwszą połowę pozycji w złocie można zamknąć w okolicach prognozowanej wartości, 1820 USD. Pozostałość aktywu można sprzedać po cenie 1905 USD. Następnie, jeśli się uda i ujrzymy cofnięcie do dotychczasowych poziomów, plan handlowy można powtórzyć jeszcze raz. Analitycy Economy Forecast Agency są nastawieni jeszcze bardziej optymistycznie. Oczekują oni, że cena będzie znajdować się powyżej $2000 w ciągu całego roku.

Rynkowi eksperci taką sytuację nazywają “flash crash”. Indie i Chiny to dwa kluczowe rynki sprzedaży detalicznej złota. Wiele części Chin jest objętych ograniczeniami z powodu covid-19. W najbliższym czasie znacznie obniży to popyt na złotą biżuterię, ponieważ sklepy są zamykane. Od początku 2022 roku złoto wzrosło mniej więcej o 5,2%, osiągając sprawie maksimum z lipca 2020 r.

Notowania kontraktów terminowych na złoto na początku drugiej połowy maja wynoszą nieco ponad 1800 dolarów za uncję. To poziom daleki od maksimów z marca, gdy na fali wojennych obaw inwestorzy i spekulanci wywindowali kurs żółtego metalu do ponad 2000 dolarów. Mniej więcej od połowy czerwca ceny złota na światowych giełdach utrzymywały się w okolicach 1800 dolarów za uncję. Dla inwestorów, którzy włożyli pieniądze w kruszec, był to czas wyczekiwania na jakiś impuls do wzrostu.

Inwestowanie w złote monety, jak i sztabki złota ma niemalże takie same korzyści, więc nie ma większego znaczenia, które z nich inwestor wybierze. Należy jednak pamiętać, aby inwestować w produkty renomowanych producentów, które cieszą się wśród inwestorów dużym uznaniem.

Jednocześnie popyt na złoto napędzają napięcia geopolityczne, które psują nastroje na rynkach akcji. Zdaniem Łukasza Zembika z DM TMS Brokers do lokowania kapitału w metal inwestorów zachęca niepewność, jaką niesie ze sobą konflikt ukraińsko-rosyjski. To napędza napływy do funduszy, a te w końcu powinny przełożyć się na wyższe ceny samego złota.

Choć zmienności wówczas nie brakowało, a S&P500 notował wahania po kilkadziesiąt procent, w ostatecznym rozrachunku rynek miał spore problemy, by skutecznie “przeskoczyć” szczyt z końca 1968 roku. Niektórzy rynek światowy ekonomiści kreślą jednak lepsze scenariusze. – Dobrą wiadomością dla złota jest to, że wiele zacieśnień monetarnych jest już wycenionych, co jest głównym argumentem przeciwko niedźwiedziom.

Efektem może być ograniczenie zwyżek cen, a nawet tendencja do poruszania się ich w przedziale wahań. Globalne otoczenie gospodarcze – przynajmniej teoretycznie – powinno wspierać złoto. Od wybuchu pandemii COVID-19 Fed, czyli amerykański bank centralny, utrzymuje zerowe stopy procentowe.

Po spadku ceny poniżej $1200 za uncję w 2018 roku złoto gwałtownie wzrosło w ciągu kolejnych 12 miesięcy, wyznaczając początek byczego trendu. Dochodowość metalu szlachetnego wzrosła prawie o 20%, a notowania podniosły się do $1556 za uncję. Pandemia amazon stock crash COVID-19 wpłynęła na wzrost popularności metalu szlachetnego jako instrumentu hedgingowania, co doprowadziło do wzrostu jego ceny. Stopy procentowe stanowią kluczowy punkt odniesienia dla inwestorów planujących ulokować nadwyżkę finansową w złocie.

Następnie cena kruszcu zaczyna stopniowo rosnąć, co jest chociażby efektem zmiany polityki fiskalnej państw czy rosnącą inflacją. Wówczas, inwestorzy chcąc zabezpieczyć majątek przed utratą jego realnej wartości nabywają bezpieczne aktywa w postaci złota fizycznego. Złoto jest surowcem o ograniczonych zasobach, co ma duży wpływ na stabilność ceny kruszcu.

Jest to najwyższy rezultat od początku zbierania danych. Odczyt poniżej 100 sugeruje, że nastroje są niedźwiedzie, podczas gdy wynik powyżej tego poziomu jest świadectwem dominacji optymistów. Na plusie, licząc od początku roku, jest złoto — i to 4 proc.

W tabeli poniżej te same dane przedstawione zostały w postaci tekstowej. Tu cena złota posiada podwyższoną zmienność i może dokonywać szybkie ruchów. We wszystkich wsparcie i opór zachodnich krajach kończy się okres bezprecedensowego wzrostu masy pieniężnej. Jej łączny zakres w USA wzrósł z $15,4 mld do $18,8 mld, rosnąc o 22%.

Contents

This helps you to build your confidence over a period of time. Thus, India Inc has experience of entrepreneurial, management professionals—not common, but known to perform well. Any of the names mentioned above belongs right there, irrespective of origins as a professional or promoter. The truth is that India Inc needs many more entrepreneurial, professional CEOs. A good entrepreneur will always know this; a business is all about the customer.

The bilateral connect platform to take Indian entrepreneurs to the global stage, thereby provide access to Global Markets as well as facilitate funding. The Industry-facing platform would enable State Governments looking to attract entrepreneurs and corporate investors into their State. Curated newsletters on markets, personal finance, policy & politics, start-ups, technology, and more.

It’s this combination of versatility, resilience, and persistence that makes up the entrepreneurial mindset, and contrary to popular belief, it isn’t genetic. It’s something like any skill, that is honed, practised, and learned over time. “The factors that make upskilling Africa’s young people to be entrepreneurial so important now aren’t going away anytime soon,” she concludes. “The idea of the brilliant innovator turned billionaire makes for a good story,” she says. “But dig a bit further and you’ll see that most successful entrepreneurs were given the tools they needed to succeed from a very young age.”

An entrepreneur is a person who starts a new business and usually risks his own money to start the venture. Examples of well-known entrepreneurs include Bill Gates, Steve Jobs, Mark Zuckerberg, etc. Five of our participants work with children as mentors. Our colleagues look for impact-grain in the business, help build potential collaborations https://1investing.in/ with other members of the business platform. In her Ted Talk, author and Stanford lecturer Amy Wilkinson talks about how comfort and a place of change are diametrically opposite. In essence, what Wilkinson is implying is that entrepreneurs have to be able to take smart risks and move out of their comfort zone to grow their businesses.

The first stage in the entrepreneurial process is some change in the socio-economic environment leading to changes in the every aspect of life in the country. Inter alia, the change creates needs for new goods and services. It is the process of extending the enterprises domain of competence by exploiting new opportunities through new combinations of its available resources. The fourth process is to coordinating the varied activities to achieve the entrepreneurial goal. In fact, the skills that make up this mindset are transferable and applicable to any other career or role as well. Whether it’s a project manager or a marketing & sales executive, lessons from the entrepreneurial playbook can be applied to a number of leadership positions.

The product or service which is being created by your organization needs to cater to the needs of your consumers. Personalising a business for consumers will also boost the sales. It enables him to keep track of the developments and the constantly changing requirements of the market that he is in. May it is a new trend in the market or an advancement in technology or even a new advertiser’s entry, an entrepreneur should keep himself abreast of it. Knowledge is the guiding force when it comes leaving the competition behind. New bits and pieces of information may just prove as useful as a newly devised strategy.

But, they always have a backup for every risk they take. Structure represents the formal, official task relationships of people in entrepreneurial activities. In other words, structure is the logical culmination of authority be entrepreneurial and responsibility at different levels. In entrepreneurial activity, policies, programmes, practices and measurement make possible for innovation and growth. They create the proper attitudes and provide the proper tools.

The next step involves how to make optimum use of these resources, to weave the cloth of success.Facing a situation or a crisis with a plan is always better. It provides guidelines with minimum to no damage incurred to a business. Planning is one of the most important characteristics of an entrepreneur.

Timely feedbacks about the business will be experienced. We make sure that the image of the entrepreneur changes and that the impact aspect starts to be heard more often. But not from the point of view that entrepreneurship is a type of possible career. We need to expand the very notion of entrepreneurship.

Also, it is important to note that an entrepreneurial spirit is a mindset; an approach towards life. Conversely there are professionals who are very entrepreneurial and take long term bets. Think of Dr DV Kapur at NTPC, or V Krishnamurthy at BHEL amongst PSUs as examples. Recall Darbari Seth of Tata Chemicals or Sumant Moolgaokar at Telco.

You can sit back and relax as our book experts publish your book one page at a time or use our free publishing platform to publish your book on your own. To put it concisely, Notion Press offers the best way to self publish books with the integration of quality services and innovation in technology. This makes Notion Press a natural choice for any author who wants to try out independent book publishing. Talk to our publishing experts, get your free publishing plan and Outpublish your competition right away. Through the SGS Entrepreneurial class, students learn about entrepreneurship while building leadership, communication, presentation, and critical-thinking skills.

Consider Ajit Narayan Haksar, who as early as the 1970s, diversified ITC into hotels, paper, and agribusiness, with his eye on reducing the company’s dependence on tobacco. His successors, JN Sapru and KL Chugh, continued to develop an entrepreneurial, professional culture. Even Yogi Deveshwar began his term similarly, but, according to some, he became more promoter than professional in the later part of his term.

Entrepreneurship is an individual’s ability to turn ideas into action. It includes creativity, innovation and risk-taking, as well as the ability to plan and manage projects in order to achieve objectives. Enhance the team performance by training them in key areas. Identify the gaps in each and every team member and plan for capacity-building sessions. This will give them the strength to handle complicated issues as commitment levels go high.

Entrepreneurship is one of our most sought-after courses as the courses in the portfolio guide the learner from the get-go and at every step of their journey. While it’s true that entrepreneurs don many hats, a crucial aspect of the job is delegation of work. It takes an immense number of skills to assemble the correct team and surround oneself with the right people. Doing everything by themselves could potentially be a route to burnout and failure. Evidently, and especially since the advent of the COVID-19 pandemic, entrepreneurship has seen infinite growth across industries and sectors. With advancements in technology, specifically communications and social media, anybody can become an entrepreneur in 2022.

I wrote down 10 commandments for myself—a practice I still follow—that listed all the reasons why I wanted to build a company of my own and why I was worthy of the same. It is what psychologists call self-affirmations and it is a powerful tool to reinforce belief in oneself. Going through the book you will realize that entrepreneurship is not magic, nor is it mysterious -and it has nothing to do with genes. All individuals have the potential to be entrepreneurial, create valuable assets, and contribute to the world in their own special way. Pick up the book if you want tips on starting or managing businesses, to explore new ideas or just to get inspiration. Because the book shows that certain kinds of people will find it much easier to found successful companies than others, it has many practical applications.

A risk-taking ability is essential for an entrepreneur. Without the will to explore the unknown, one cannot discover something unique. Investing in ideas, nobody else believes in but you is a risk too. Professionalism is a quality which all good entrepreneurs must possess. An entrepreneurs mannerisms and behavior with their employees and clientele goes a long way in developing the culture of the organization.

Good entrepreneurs know they can learn from every situation and person around them. Information obtained can be used for the process of planning. He should face his losses with a positive attitude and his wins, humbly. Any good businessman will know not to frown on a defeat. Failure is a step or a way which didn’t work according to the plan. A good entrepreneur takes the experience of this setback and works even hard with the next goal in line.

For business leaders who need to interact and network with multiple stakeholders, employees, and peers, a simple habit like this can go a long way in cementing their reputation and likeability. If recent entrepreneurship trends are anything to go by, anybody can be an entrepreneur, connections notwithstanding. Knowing the right people always helps but it’s the ability to forge long-term relationships and add real value, that takes businesses to great heights. Often seen as a starting point for entrepreneurship, this is someone who is interested in the nitty-gritty of starting a business venture. Such an individual may also branch out into an entirely different career path as well over time.

It also allows you the ability to put in those extra hours in the office which can or may make a difference. At the beginning of every entrepreneurial venture or any venture, there are hurdles but your passion ensures that you are able to overcome these roadblocks and forge ahead towards your goal. Reliability results in trust and for most ventures, trust in the entrepreneur is what keeps the people in the organization motivated and willing to put in their best.

Many would say that the stories of entrepreneurs, as mentioned earlier, are inspirational and are good examples to learn from either in a board room or in a classroom. Here are some effective ways to enhance your entrepreneurial knowledge. Skills For Every EntrepreneurThese are some of the necessary skills an aspiring or a-would-be entrepreneur should possess in order to succeed as an Entrepreneur.

Yes, if you are solving a unique problem with resources and innovation. Starting a brick-and-mortar business requires a similar skillset and passion as starting an eCommerce business. The main difference is that an eCommerce store typically requires less investment upfront. Successful entrepreneurs look for opportunities and are consistently evolving. Develop a mindset for solving problems, innovating, and adding value. So it is not uncommon for entrepreneurs to find a partner to help alleviate some of the financial burdens.

They should also have practical decision-making skills. It is essential to be mentally agile and develop cost-effective, adaptable solutions. In addition, they must make logical decisions to sustain the business. Ever since the COVID-19 pandemic, people have realized the importance of using local products and resources, and small businesses have been on the rise.

US stocks that move a lot every day, in percentage terms (5%+). The red line is two standard deviations above the recent average. PD stock is above this level as well, and it could be the trigger to sell or short PD stock. If UL gets there it means there is a good chance it keeps going lower. The trader who bought it at $56 would sell at $54 and take a small loss.

If this happens, you are expected to wait for the two lines to cross again, creating a signal for a trade in the opposite direction, before they exit the trade. The bottom part of the chart is the Relative Strength Index momentum indicator. As you can see, UL stock was oversold at the very end of October. The bottom part of the above chart is the Relative Strength Index .

SMAs with short lengths react more quickly to price changes than those with longer timeframes. The Fibonacci retracement pattern can be used to help traders spot support and resistance levels, and therefore possible reversal levels on stock charts. There are key features to look out for when searching for swing trading stocks. Swing traders use technical analysis to identify patterns, trend direction, and potential short-term changes in trends. Swing traders will try to entice upswings and downswings in stock prices. Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable.

There is support for the stock around the $2,050 level. If this level breaks, it could be the trigger or catalyst for a swing trader to sell short GOOGL stock. In addition avus capital to having a well-defined exit strategy, successful swing traders usually consider two other things. I don’t hold swing trades through earnings announcements.

Open positions have the potential to be carried over from one trading session to the next and maintained for a period ranging from one week to one month. In your search, you can identify stocks with the appropriate criteria by setting parameters such as return on equity, price-to-earnings ratio, and dividend yield. Whether you are a rookie trader or a seasoned professional in the field, you can profit from these resources. The economy and the market in general tends to move in cycles of boom and bust. Thus, it is important that you know at which point in the cycle the markets you are in. Some stocks tend to perform badly during economic downturns, while some stocks are known to perform well in such circumstances.

In fact, Kyle’s trades across all sectors, however, his most explosive profits came from trading stocks in the biotechnology sector. He doesn’t run a signal service; he only focuses on the mentorship program. If you select any of these stocks for your trades, you do so at your own risk. Timing the market swings is one of the most difficult tasks amongst swing traders.

All trading carries high risk; however, it’s how you handle that risk and plan for it that separates the better traders from the pack. Swing trading is not safer than day trading; It is simply a method that traders choose because it either works for them or compliments their trading style. With much consideration, research, and chart analysis, traders uncover which stocks have the most potential for actionable setups.

The market never slows down, which means making sound decisions is crucial to staying in the game. If you want a daily updated list of stocks to day trade, that are making the biggest moves each day, I recommend getting aFinviz Elitesubscription. Then, run a scan before the market opens and during the day.

Swing trading stocks requires you to hold the position open over a few weeks. This can make the stocks vulnerable to news that you never expected. Therefore, it is important that you already have a plan in mind.

The dependence of historical trading activity and price movements is always not a good stock indicator, hence it is risky investment style. Below the price chart is the TTM_Squeeze, which alerts traders that https://forexbroker-listing.com/ energy is building up in stock, potentially leading to an explosive move. In this screenshot, the indicator gave the trader a heads up that the stock was consolidating, squeezing, and preparing to move.

You can watch for those to pop on weekends on the TradeThatSwing hompage. I’ll add more sections, such as a Canadian list, over the next several weeks. The reopening of businesses post-pandemic and the huge influence of social media in everything around us makes Facebook an ideal swing stock.

It is a type of trading that tries to secure short to medium term gains in a stock over a few days or even several weeks. Some people think that day trading stocks is an easy way to earn a living. However, the truth is that like any other job, it is not easy for new traders to do well in the market. It needs a lot of effort and you must be vigilant to locate stocks with potential.

The stocks are selected based strong recent relative performance to the S&P 500. If I’m going to buy something I want it to have some “oomph” behind it. If you need a copy of the symbols to plug into your own software, you can copy them off the Finviz Tickers using the link above. If you’re looking for a way to trade these types of stocks, consider the Trend Trading Strategy for High Momentum Stocks.

A logical place to get stopped out is around the $12.10 level. If it got back up there, it means the buyers have returned. The swing trader who went short would buy back their shares and take a small loss if it got back up to that level.

You can’t see it on this chart, but last February XLRE stock ran into resistance at this level. This means there’s a chance it hits resistance there again. Before a trader takes a position, they should two targets.

As a result, there are some inherent risks that stock traders should be aware of. Stanley Black & Decker has a market valuation of around $29.7 billion. The below graph shows the stock performance of Stanley Black and Decker over the past two years. The most overlooked data for traders are economic reports on the trading calendar. They should refer to the significant dates of planned events, such as quarterly earnings reports, announcements and meetings of the Central Bank, and even major global events. Learn the basics of trading stocks and build a solid foundation for years to come.

A favorite technical indicator that Simpler traders use as part of their trading strategy is the ST-Squeeze. This indicator alerts traders when the price action of a stock consolidates, or trades in a tight range, and builds up energy before its next move. The following list is a sample of the day trading stocks that tend to move more than $2 per day, but that are priced near $300 or below. If you have plotted a channel around a bearish trend on a stock chart, you would consider opening a sell position when the price bounces down off the top line of the channel.

Contents

Token XRP to ekwiwalent pozwalający na zrównanie waluty z obecną stawką Ripple, przeniesienie pieniędzy cyfrowych do odbiorcy i spieniężenie go w tradycyjne aktywy finansowe. Pierwszym krajem, w którym kryptowaluta stała się oficjalnym środkiem płatniczym jest Salwador. Niektórzy uważają, że czas wizyty może nie być przypadkowy. Niektórzy zwolennicy XRP spekulowali nawet, że CFTC może przejąć rolę regulatora waluty, co może oznaczać, że XRP zostanie sklasyfikowany jako towar.

Oferuje bardzo wysoką skalowalność (podobną do sieci płatniczej Visa!), ale z drugiej strony jest ona uzyskiwana kosztem centralizacji i potrzeby korzystania z bram sieciowych. Konsensus sieci Ripple bazuje na komunikacji pomiędzy bramami sieciowymi, które pełnią tu funkcję węzłów, natomiast operacje są podpisywane przy wykorzystaniu kryptografii krzywych eliptycznych. Zaimplementowany algorytm konsensusu różni się więc od tego, który występuje w sieciach zdecentralizowanych, takich jak Proof of Work czy Proof of Stake. Wykres oraz aktualny kurs Ripple znajdziesz w treści artykułu poniżej. Projekt Ripple wykorzystuje technologię blockchain w jeden z najbardziej zaawansowanych sposobów.

Kontrakty CFD to złożone i bardzo ryzykowne instrumenty, mogące spowodować szybką utratę kapitału ze względu na dźwignię finansową. Od 67% do 89% inwestorów traci swoje środki handlując CFD. Musisz rozważyć, czy jesteś w stanie ponieść ryzyko utraty zainwestowanych środków. Za powstaniem Bitcoina i wielu innych kryptowalut stoi chęć uniezależnienia ludzkości od scentralizowanych instytucji finansowych. Chodzi tu o świat bez pośredników finansowych, którzy mają kontrolę nad przepływami pieniężnymi, a przy tym oferują wolne i kosztowne transakcje finansowe.

Ripple uznany jest za start-up z San Francisco, a jego system płatności jest podobny do blockchain. Protokół płatności jest kompatybilny i bardzo podobny do innych kryptowalut, walut papierowych oraz rynku towarów. Ripple umożliwia integrowanie protokołu na własnym systemie klienta. Fundusze w formie tej waluty są przekazywane w czasie rzeczywistym, więc mamy tutaj do czynienia z transakcjami błyskawicznymi. Prezentowana kryptowaluta posiada blokchain podobny do tego występującego w Bitcoin.

Portal Internetowy Poznajrynek.pl nie ponosi żadnej odpowiedzialności za decyzje inwestycyjne podjęte na podstawie lektury zawartych w nim treści. Ripple – kryptowaluta Ripple to system płatności oparty na technologii blockchain. Po Bitcoinie i Etherum jest trzecią co do wielkości kryptowalutą.

Prosimy o upewnienie się czy rozumieją Państwo ryzyka związane z transakcjami na rynku forex lub zasięgnięcie porady niezależnego doradcy co do zaangażowania w tego typu transakcje. Forex.pl promuje usługi finansowe licencjonowanych podmiotów zarejestrowanych w Unii Europejskiej. Nie prowadzimy bezpośredniej sprzedaży produktów finansowych.

Uruchomiony w 2012 roku XRP dąży do umożliwienia przeprowadzania bezpiecznych, natychmiastowych i prawie w pełni swobodnych transakcji finansowych na globalną skalę o dowolnej wielkości i bez obciążeń zwrotnych. Po raz pierwszy zetknął się z kryptowalutami na początku 2017 roku i od tego czasu jest zafascynowany technologią i możliwymi globalnymi problemami, które może rozwiązać. Rewolucyjny potencjał technologii blockchain ekscytował go i przyczynił się do jego zawodowego skupienia na digitalizacji i bitcoinie.

Także w roku 2018 Ripple zaistniała na rynku w Indiach, gdzie podłączyła do swojej sieci wielu dużych klientów, m.in. W roku 2016 do podmiotów wykorzystujących rozwiązania Ripple dołączyły banki z Japonii w ilości ponad 80% instytucji finansowych z tego kraju. Konsorcium SBI Holdings utworzone przez Myanmar Central Bank zamawia organy państwowe, aby nie korzystać z walut obcych przez Reuters te podmioty, dostało we wrześniu 2018 licencję na korzystanie z XRP w celu świadczenia usług finansowych. Projekt ruszył w praktyce w 2005 roku, jako platforma błyskawicznych transakcji oparta o model IOU , czyli o kreowanie zobowiązań pieniężnych między wzajemnie ufającymi sobie stronami.

Zaletą walut opartych na oprogramowaniu Open Source, takich jak XRP jest ich przejrzystość i duża wiarygodność. Każda zainteresowana osoba może przeglądać, pobierać lub modyfikować kod źródłowy, co oznacza, że skopiowanie kodu i stworzenie nowej kryptowaluty jest stosunkowo łatwe. Trudniejsze jest jednak zbudowanie wiarygodności dla kryptowaluty, która zwykle wiąże się z projektem biznesowym, który za nią stoi. Najpopularniejszym miejscem, w którym udostępniany jest kod źródłowy kryptowalut typu Open Source jest platforma GitHub.

Mamy nadzieję, że pomogło Ci to lepiej zrozumieć, czym jest i jak działa Ripple. Firma Ripple była krytykowana za swój scentralizowany charakter, ponieważ większość tokenów XRP należy do Ripple Labs. Ta centralizacja oznacza, że Ripple jest mniej zdecentralizowany niż inne kryptowaluty. Innym problemem, z którym boryka się Ripple, jest fakt, że nie jest on jeszcze powszechnie akceptowany. Chociaż firma Ripple współpracuje z wieloma dużymi instytucjami finansowymi, nie jest jeszcze powszechnie używana.

Waluta Ripple po raz pierwszy pojawiła się na giełdach w 2014 roku i początkowo kosztowała mniej niż 1 centa. Jeszcze w tym samym roku osiągnęła swój najniższy w historii poziom cenowy 0,0028 USD. Natomiast All Time High, czyli tak zwany szczyt szczytów cenowych, kryptowaluty XRP został ustanowiony w styczniu 2018 roku i sięga 3,84 USD (stan na grudzień 2020 roku).